Monzo Business: Active vs Passive Non-Financial Entities (NFEs) - Business Banking - Monzo Community

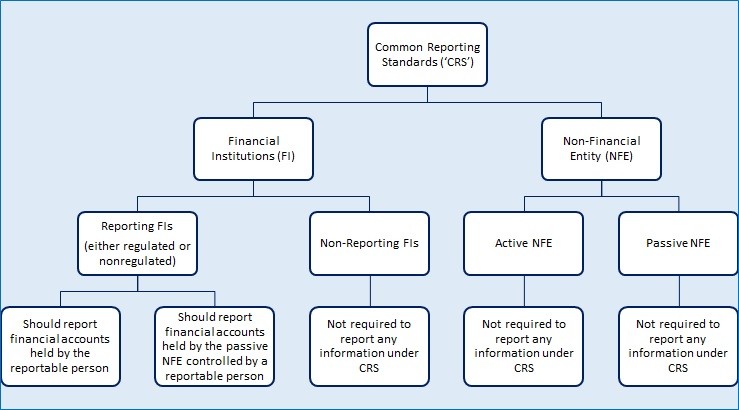

Gesica - Dear Valued Agents, Looking for more insights or useful guides? We are back with “CRS Entity Type: Financial Institution (FI) versus Non-Financial Entities (NFE)” and “Financial Underwriting Guidelines: Non-Income and